Not Write offs, Corporate Loan Waivers

Banks Recovered Only 10% Bad Loans After Writing Them Off !!

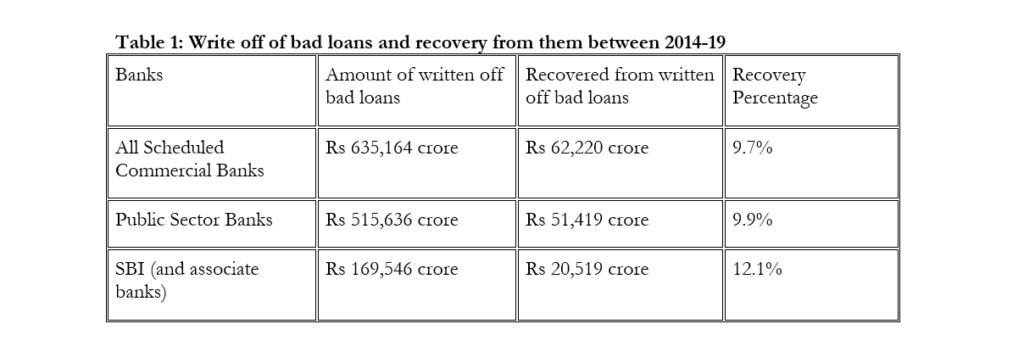

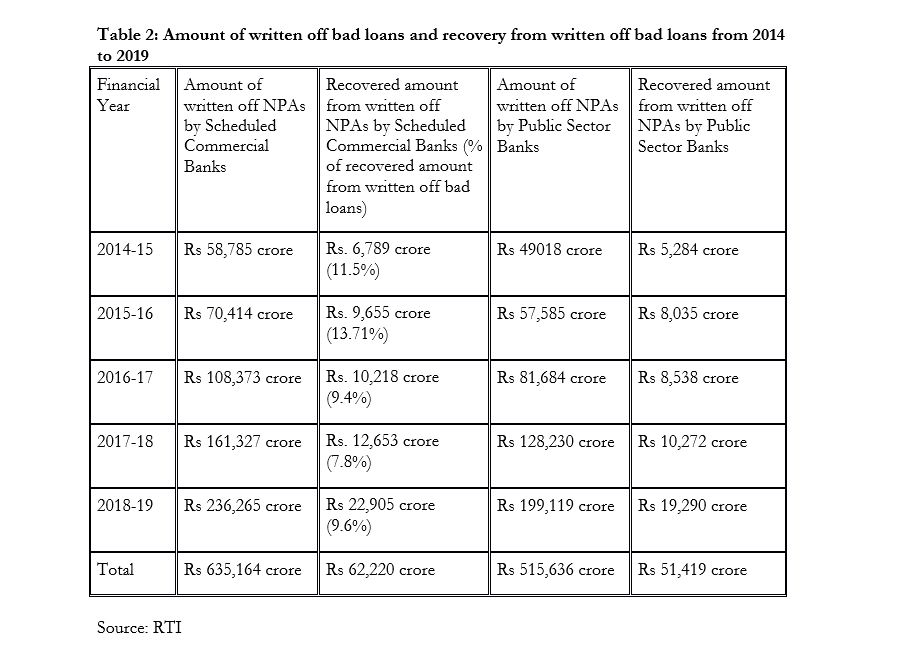

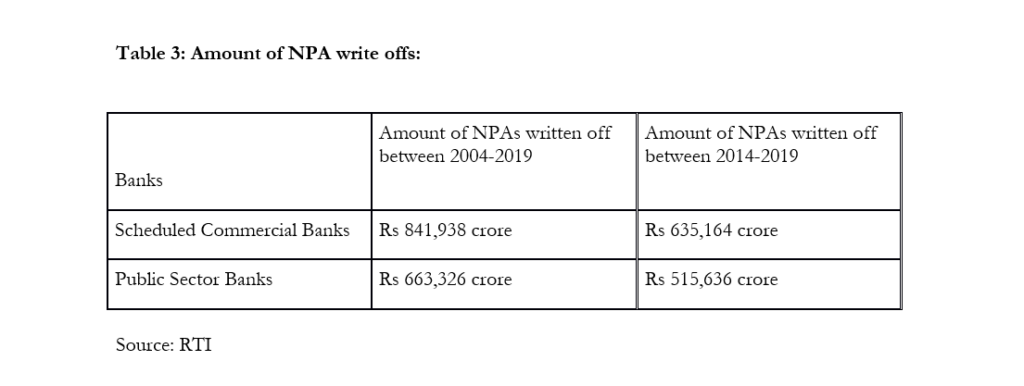

According to an RTI response received from Reserve Bank of India, between 2014 and 2019 scheduled commercial banks in India have written off bad loans worth Rs 6.35 lakh crore and have recovered only 9.7% i.e. Rs 62,220 crore from written off loans. While in response to the RTI, RBI didn’t provide the data for recovery of the written off loans for the period before 2014, but provided the details of bad loans that were written off. From 2004 to 2019, scheduled commercial banks wrote off a total sum of Rs 8.41 lakh crore worth bad loans from their books, 75% of which – Rs 6.35 lakh crore were written off only in previous 5 years between 2014 and 2019.

Banks write off (remove) bad loans from their balance sheets in order to clean their books and for tax efficiency. Later, any recovered amount from those loans is added as profit. The data provided by the RBI shows that almost 90% of the loans that were written off (removed) by banks are never recovered. K C Chakrabarty, former deputy governor of Reserve Bank of India, have also termed these write offs a scam where most of the written off loans are big loans issued to corporates.

These bad loans, technically called Non-Performing Assets (NPAs) has been the primary cause of the banking crisis for about 5 years now. The government of the day is quite happily claiming that bad loans have come down and banks are doing a good job of recovering the bad loans. This reduction in NPAs that they are claiming is in reality not much and definitely not due to recovery. Gross NPAs declined from 11.5% in 2018 to 9.3% in 2019, but it has more to do with the writing off of bad loans than the recovery made by banks.

The amount of bad loans can be reduced in two ways, either through the recovery or by writing them off. Finance Ministry has been responding in parliament as well as outside parliament that “comprehensive steps have been taken under the 4R’s strategy – recognising NPAs transparently, resolving and recovering value from stressed accounts, recapitalising PSBs, and reforms – to reduce NPAs of Public Sector Banks”. But there is no mention of continuous write offs of large amount of bad loans by public sector banks.

The experts of the banking sector have repeatedly raised questions about writing off of bad loans. In response to the question asked in Lok Sabha, Ministry of Finance said that these write offs are a regular exercise to clean up the balance sheet, avail of tax benefit and optimise capital, in accordance with RBI guidelines and policy approved by their Boards, and borrowers do not get benefitted from writing off NPAs, the process of recovery of dues from them continues (Lok Sabha, Unstarred Q 1285, 25/11/2019). The Finance Minister also gave the same response when RBI released list of top 50 willful defaulters where banks had written of Rs 68,000 crore and people raised the questions about them. Interestingly, again there was no mention of recovery made by banks from the loans that were written off by the banks.

The following tables proves that government’s claims of “write off does not mean waiver, borrowers do not get benefitted from write offs, banks continue to recover those loans” are nothing but a white lie. The large amount of write offs and negligible recovery shows that in the name of cleaning the balance sheets, banks have been waiving off corporate loans through write offs.

In 2015, to get the real picture of bad loans, the then RBI governor Raghuram Rajan made rules of NPA classification stringent and asked banks to identify bad loans instead of ever greening them through restructuring. Non-performing assets spiraled from Rs 2.6 lakh crore in 2014 to Rs 3.23 lakh crore in 2015, peaked in 2018 with Rs 10.35 lakh crore and after a slight decrease it was Rs 9.49 lakh crore in 2019. Since then the government and the RBI both are grabbing every opportunity to claim that bad loans are decreasing, triumphing the 4R’s strategy and IBC process for recovering the bad loans. But the data from Reserve Bank of India portrays completely different picture with banks writing off huge amount of bad loans and barely recovering 10% of the loans that banks had written off from their books.

Public sector banks are not performing any better and have recovered only 9.9% i.e. Rs 51,419 crore from the written off bad loans in the period between 2014 and 2019, where the amount of written off bad loans by them in the same period is Rs 515,636 lakh crore.

State Bank of India, the largest bank of India has also written of Rs 1.6 lakh crore in these 5 years and have only recovered Rs 20,500 crore from the written off bad loans, showing that merger of five associate banks with SBI did not improve the recovery side of the bank.

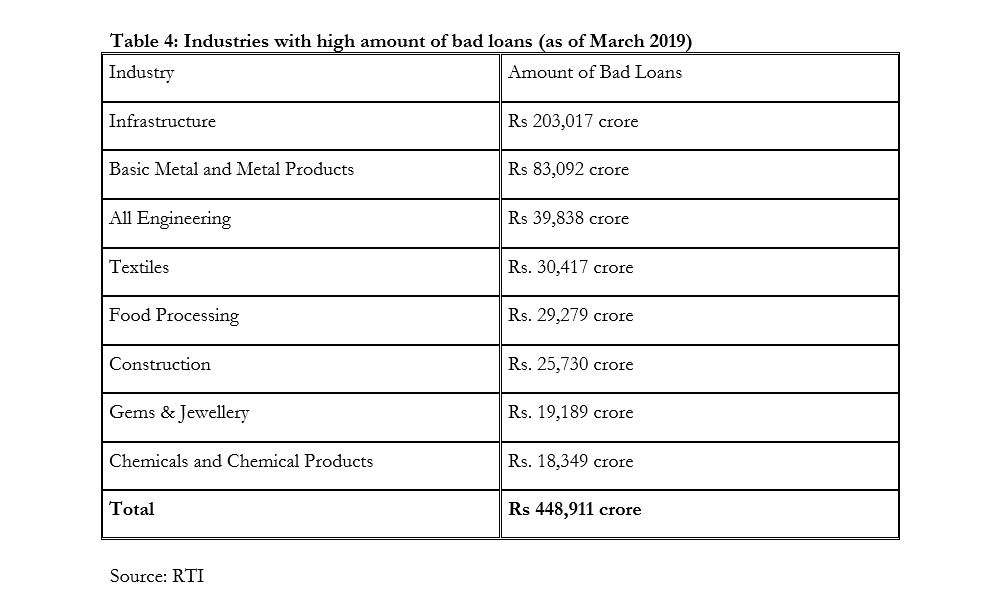

While the pro-business sections and media never miss an opportunity to target and calling out farm loan waivers as bad for banks, there is hardly any noise on the massive write offs of corporate bad loans. The recent statements by former governor Urjit Patel and former deputy governor Viral K Acharya about attempts to weaken the IBC process to benefit big corporate defaulters shows that government is letting corporates take advantage of banking system and not trying to recover the bad loans. In 2017, 12 companies identified by RBI for bankruptcy had total NPAs of worth Rs 2.44 lakh crore, almost 25% of gross NPAs of that time. Read: List of 12 companies constituting 25% of total NPAs. Till December 2018, the top 100 borrowers of Indian banks had bad loans worth 4.44 lakh crore. Read: Nearly 50% of All NPAs Due to Loans Taken by Top 100 Borrowers. In 2019, Infrastructure and Metal industry alone have bad loans of approx. 3 lakh crore. Out of the total Rs 9.5 lakh crore bad loans in 2019, 81.8% loans were of the amount higher than Rs 5 crore, indicating that small retail credits and farm loans are not the primary cause for the bad loans.

In 2019, Infrastructure and Metal industry alone have bad loans of approx. 3 lakh crore. Out of the total Rs 9.5 lakh crore bad loans in 2019, 81.8% loans were of the amount higher than Rs 5 crore, indicating that small retail credits and farm loans are not the primary cause for the bad loans. Even according to the RBI report on Agriculture, in the year 2017 – 18, which saw the most number of farm waivers (seven states) was Rs 49,000 crore (budgetary allocation) but in the same year the amount of bad loans written off was Rs 1,61,327 crore. The farm waivers are used as a political tool and electoral gimmick, with high pitch announcements by political parties and state governments, but most of the time they are conditional and are not implemented fully stating budget constraints, but this is never the case with write offs that are silently done year after year in the name of cleaning the books and never recovered thereafter. The huge loss caused by the writing off of corporate bad loans with negligible recovery percentage has also resulted in exponential increase in service charges on banking services for depositors of the banks.

It is high time, we should stop calling them technical write offs, this is nothing but a corporate loan waiver and fraud with the depositors – the primary financiers of the banks. The banks must immediately stop this practice, government should formulate strict laws with respect to writing off of bad loans and to strengthen the process of recovery mechanisms instead of diluting them.