Random Reflections

The five state election results are being analysed from various angles. Communal polarisation, EVM manipulation, and welfare schemes are the ones being discussed much more. After the UP Assembly elections, I wrote about how the banks helped BJP to win. No one had seriously looked at it. The opposition parties didn’t take it seriously in the recent 5 state elections. There could have been a counter-strategy if they did.

Let us analyse the bank loans under a few schemes in these five states.

Mudra Loan:

This scheme gives 3 types of loans- under the Shishu category, up to Rs. 50000 loan can be given, under Kishore, up to Rs. 5 lakhs and under the Tarun scheme, up to Rs. 10 lakhs can be availed. It can be given to existing businesses or to start a new business. The loan is covered under a credit guarantee scheme. No collateral is needed. It is disbursed by the banks as well as Non-Banking Financial Companies (NBFCs). This scheme is for 2015-26. The Banks are giving these loans from the depositors’ money and not from the Union Government budget. Up to September 2023, the number of loans given under this scheme are 44, 52, 24,928 or Rs. 44.5 crore. The amount sanctioned is Rs. 26,12,278 crore. In comparison with last year, the year 2022-2023 saw an increase of 37% in the amount and 14% in the number of loans given.

More loans are given under the Shishu & Kishore scheme and the average loan size is Rs.73,489 under all three schemes.

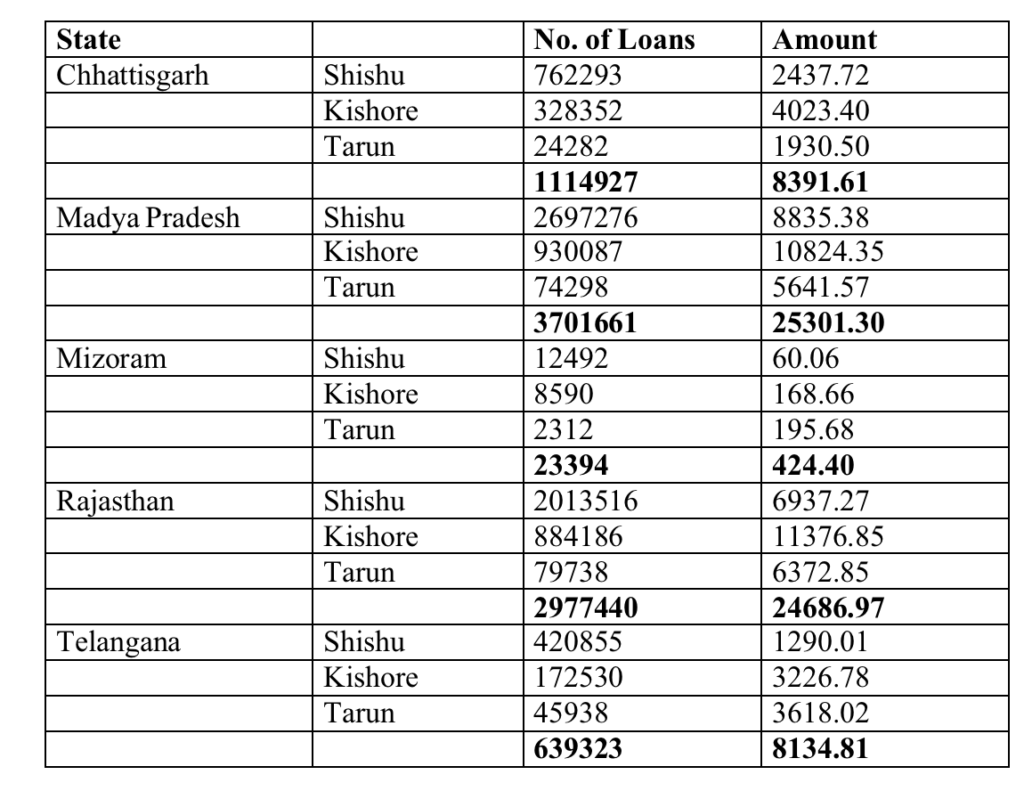

Now let us see state-wise.

This was in the year 2022-23 alone! The total number of loans sanctioned in the year was 6,23,10,598 and the amount sanctioned was Rs. 456537.98 crores. (Data break up for other years is not available on the website mudra.org.in.)

If we calculate the percentage of the total number of accounts state-wise, out of the total number of loans sanctioned, Chhattisgarh would have received 79.25 lakh loans for 56.5 lakh households (2011 census), which is almost 1.5 person per household. In Madhya Pradesh, 2.64 crore loans were given to 1.51 crore households which means 1.75 person per household.

In Rajasthan, 2.12 crore would have gone to 1.27 crore households, which is 1.6 person per household. I am leaving out Mizoram.

This clearly shows that more than one person per household would have received a Mudra loan! Some households would not have received and some would have received 2 or 3 loans too. These borrowers have been told that this is Modiji’s gift and need not be repaid. I have seen this happening in Kanyakumari district, where young people are being asked to join the BJP by offering loans. Banks are pressurised to give loans from top to bottom.

On the other hand, some Non-Banking Finance Companies send emails with the logo of GOI Mudra saying they have received a loan application which they are processing and demand further details which they may later share with BJP. Recently, I received an email from Mudra Loan quoting an application number for a loan of Rs 1000000 (which I had never applied for) and when I clicked ‘Check now’ it took me to a website called lendingkart.com which I had never heard about. This is luring people, intruding into their privacy, lending without due process and using it for political profit which is condemnable.

The Finance Minister instructs bank chiefs and they give instructions to branch managers and field officers, through whom the targets are fulfilled. Now there is pressure on the banks to lend to NBFCs which further lend to borrowers at huge interest and collect service charges too. Remember the launch of 59-minute Mudra loan? Customers were asked to apply online and pay Rs 1000 as processing fee. The company just forwarded the applications to banks and nobody got a loan in 59 minutes. Only one Gujarati fellow made huge money and disappeared!

Now BJP is itself collecting applications and submitting them to the banks. In Tamil Nadu, they even opened a website for this purpose, but there was not much response and they have shifted the focus to house visits.

In the states where Congress was in power, it could have used this to canvass among people that they have encouraged this through the state-level bankers committee and district credit committees.

These are loans and not gifts. They have to be repaid. If one does not repay, their names will be listed in CIBIL and they cannot avail any other loan from any bank. The young people availing these loans should be made aware of this. With 44 crore beneficiaries, it seems the scheme is covering almost every household! As per the 2011 census, there are 24 crore households in the country. This means every household has one or two loans, making the reach of the scheme very high, while more loans are being sanctioned every day. Where are these 44 crore enterprises? If they had existed, we could have witnessed one in each house. Most of them do not exist because the economy cannot support so many enterprises. These loans are inadequate for running a successful enterprise. The failure leads to default, frustration and spoiling the future of many.

PM Svanidhi Loan:

These are loans given to street vendors. Under this scheme, 49.48 lakh street vendors have been given a loan of Rs.10000 for running a stall. This is also used for propaganda.

We need to have deeper grassroots studies to see what is happening on the ground. Turning a vast population of unemployed youth into failed entrepreneurs and cheaters will be catastrophic.

There is a need to have a critical study of PMJAY which appears to benefit doctors and private hospitals than the patients.

Similarly, every scheme needs to be critically analysed to see where the benefits are going. There are 440 central schemes so far.

Here are some of the flagship schemes of the Indian Government as of 2023:

- Pradhan Mantri Jan Dhan Yojana (PMJDY)

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

- Pradhan Mantri Suraksha Bima Yojana (PMSBY)

- Ayushman Bharat Yojana (ABY)

- Pradhan Mantri Awas Yojana (PMAY)

- Atal Pension Yojana (APY)

- Beti Bachao, Beti Padhao Yojana

- Digital India Programme

- Swachh Bharat Abhiyan

- Make in India Programme

- National Rural Livelihood Mission (NRLM)

- Pradhan Mantri Ujjwala Yojana (PMUY)

- Skill India Mission

- Start-up India Programme

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- National Health Protection Scheme (NHPS)

- Pradhan Mantri Mudra Yojana (PMMY)

- Smart Cities Mission

- Udaan Scheme

- Rashtriya Swasthya Bima Yojana (RSBY)

- Poshan Abhiyan

Read more about these schemes here.

Banks run on peoples’ deposits. They should not be used to gather votes. The repayment habit will go. That will lead to a banking crisis. Hope the political parties wake up. Hope the citizens of the country see the danger.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram and WhatsApp. Click here to join our Telegram channel and click here to join our WhatsApp channel and stay tuned to the latest updates and insights on the economy and finance.