As of 31st March 2024, the Indian Scheduled Commercial Banks (SCBs) had Rs 21,04.039 crore in Current Account, Rs. 63,00,792 crore in Savings Bank Accounts, Rs.12,51,022 crore in Term Deposits totalling Rs. 2,09,55,853 crores. Using these deposits, banks had provided a loan of Rs.1,69,13,694 crore. Banks have no funds of their own to lend to the borrowers. Their paid-up capital is very little, and they are kept as securities.

The plain truth is- ‘without depositor’s funds, banks will cease to exist.’

Hence, the banks have a primary responsibility towards the depositors. They should not only keep the deposit safe but also provide a reasonable return through interest.

As the controller of the monetary system, the Reserve Bank of India has the responsibility to ensure a reasonable return to the depositors; as it is their money that powers economic growth through loans given to different sectors.

If we analyse the interest on Term Deposits or Fixed Deposits in the last 2 decades, from 1999 to 2000 the average Interest on Fixed Deposits was 10 to 10.5% which came down to 5.05% to 5.35% in 2021-22 and at present it ranges from 6.48% to 6.91%.

Till the mid-1980s, the RBI had fixed a ceiling on Interest Rate on deposits, which was 8%. With deregulation, the Interest rate went up to more than 14% and in 1992 RBI introduced a ceiling of 13%. Again in 1997, the RBI deregulated interest rates. So the Banks are free to decide interest rates on deposits. The highest Interest rate offered by a Public Sector Bank is 3.5% to 7.25% in Punjab National Bank, depending on the period of deposit. Among the private banks, it is 3.5% to 7.8% at RBL Bank while the AU Small Finance Bank offers 3.75% to 8%. Among the Non-Banking Finance Companies (NBFCs) Bajaj Finance offers 7.1% to 8.35% interest rates. Senior Citizens are offered 0.5% more which used to be 1% more during the nineties.

In the last 10 years, the Consumer Price inflation averaged 5.5%. Hence, the net return for most of the depositors could be just 1% or less.

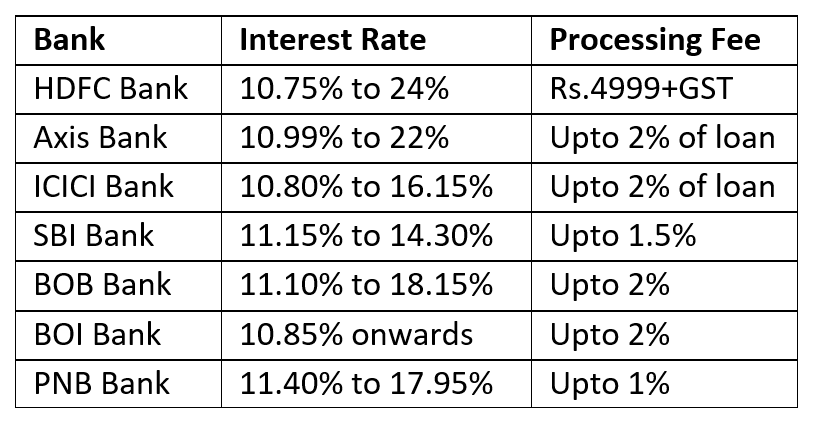

Personal loan interest offered by Bajaj Finserv ranges between 11% to 35%. The Personal Loan Interest charged by a few banks is given below.

Even on other loans, banks charge 12% to 18%. It is clear that the banks are looting the depositors with very little interest paid on the fixed deposits.

The combined profit of public and private banks was Rs. 2.2 lakh crore in 2023 and reached Rs. 3.1 lakh crore in 2024. Was this profit not made out of the deposits of common people?

The Crime

In the name of reforms and competition, the banks were allowed to fix interest rates on deposits. The Interest on Savings Bank Account which was 5% in 1977 for non-cheque facility accounts came down to 4.5% in 1978 but went up to 6% in 1992. In 2003, it was brought down to 3.5%, and now it has come down to 2% to 3%, except in a few small finance banks which offer more.

As of March 2024 out of the total deposits, 9.8 % was in CA, 30.8% in SB and 59.4% in FD.

If the banks had paid 5% interest on the SB deposit of Rs.63,00,792 crore, the general public could have earned Rs.3,15,039.6 crore instead of Rs.1,26,015.84 crore. The loss is Rs 1,89,023.76 crore.

In the fixed deposit of Rs.1,25,51,022 crore if 4% Interest was paid more than Rs.5,02,040.88 crore would have been earned by the depositors.

The loss of interest in the last ten years is Rs.18,90,237.6 crore for Saving Bank account holders and Rs. 50,20,408.8 crore for fixed deposit holders. Together the total loss in the last 10 years is approximately Rs. 69,10,646.4 crore.

When banks charge interest on loans ranging from 10.75% to 24% is it not possible to pay 5% interest on saving bank accounts and 10% interest on fixed deposits? After all, this deposit alone is used for lending. How can the intermediary earn much more than the principal investor?

Pathetic State of Current Account Holders

Banks had a balance of Rs.21,04,039 crore in current accounts as of March 2024. CA is 9.8% of the total deposits. No interest is paid on this. Initially, CA was opened by businessmen, especially traders who would transact almost every day. They had to keep a minimum balance of Rs 10000 in the account. But the Government and RBI forced all Societies, Trusts and Non- Governmental Organisations to have current accounts. The huge deposit in these is free for the banks to on-lend or even invest elsewhere.

In Hong Kong, current account holders earn interest.

Most of the Societies, Trusts and NGOs are charitable institutions. They have been deprived of their interest by forcing them to keep funds in current accounts instead of saving bank accounts where they can at least get some minimum interest.

Household Individual deposits provide money to the Banks!

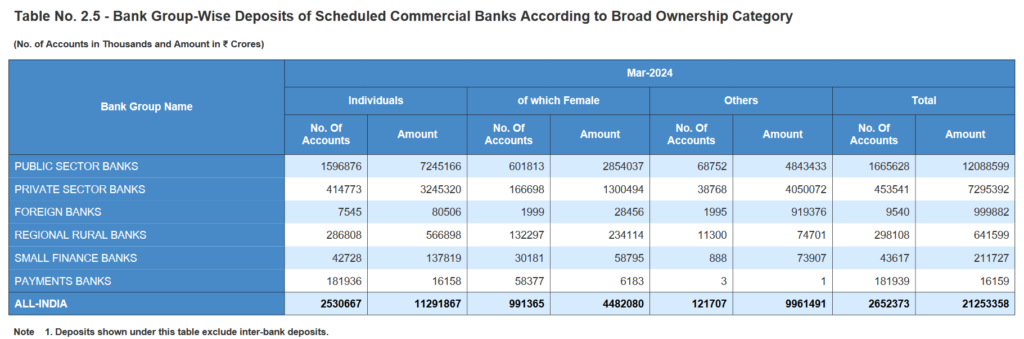

As of March 2024, there are 16,14,51,000 current accounts with a balance of Rs. 20,60,789 crore, 22,17,10,000 saving bank accounts with a balance of Rs. 66,48,151 crore and 27,42,13,000 FD A/Cs with a balance of Rs.1,25,44,418 crore (This small discrepancy is present in RBI data itself. See Tab 2.5 of BSR 2)

Out of the 2,65,23,73,000 A/Cs, 2,53,06,67,000 A/Cs belong to individuals (95.41%) and their deposit is Rs. 1,12,91,867 crore (53.12%) out of the Rs. 2,12,53,358 crore. It is these Individuals who need to be compensated.

Out of these individuals, 99,13,65,000 are women, who save money with great difficulty. Out of Rs.1,12,06,392 crore saved by individuals other than the Hindu Undivided Family, Rs 42,92,801 crore (38.3%) is saved by senior citizens who require regular income from their savings.

These small depositors from the lower and middle-income groups will spend their earnings quickly, which will help the economy to grow. Unlike the neo-rich, they don’t invest in assets which do not help the economy to grow.

Where do people deposit and why?

Public Sector Banks have 1,66,56,28,000 deposit accounts which is 62.7% of the total accounts. The deposit outstanding in March 2024 is Rs.1,20,88,599 crore which is 56.2% of the total deposits. Regional Rural Banks (RRBs) have 29,81,08,000 accounts (11.2%) with a balance of Rs 6,41,599 crore (3.1%) whereas the Private Banks have 45,35,41,000 accounts(17.2%) with a balance of Rs 72,95,392 crore (34.32%).

It is very clear that people have faith in the public sector banks which are Govt owned, and which are also nearer to them and allow less minimum balance. Private Banks cater to the upper-income group. That’s why their number of accounts is less but the balance is more.

Hence, the Public Sector Banks have a higher responsibility to keep up the faith.

What needs to be done?

If the depositors withdraw in large numbers, the banks will collapse. Nowadays, every bank runs special campaigns to mobilise CASA deposits (current account & Savings account) as it is cheap. Even gifts are offered. Instead, they can do these:

- Pay 3% Interest on CA. Banks may fix a maximum number of transactions per month above which they can charge.

- Pay 5% interest on SB A/Cs and allow Societies, Trusts & non-profit NGOs/ Companies to have SB A/Cs

- Pay at least 10% Interest for fixed deposits for a period above 24 months. Pay 11% to Senior Citizens. So that they know how much they can lend without fear of payment to the depositor in a short time.

- Encourage Recurring Deposits of longer periods with 10% or more interest.

- Bring back the Perennial pension plans which existed in SBI and other banks for periods up to 20 years. For a monthly deposit of Rs 100 for 240 months, you could get a monthly pension of Rs 1000 per month. It is actually the interest paid on the maturity value. If one stops the pension, they get Rs.100000.

For years the Government and the RBI have allowed banks to flourish at the cost of the depositors who are the real owners of the banks. They are not on the Boards of Banks; they are not told where their money is invested, and they are not even properly cared for. Almost every customer complains of poor service due to shortage of staff.

How to take this forward?

Trade Unions, Civil Society, Customer Rights Organisations and people have to come together and launch a successful campaign to make both the depositors and the banks understand the value of people’s money.

Thomas Franco is the former General Secretary of All India Bank Officers’ Confederation and a Steering Committee Member at the Global Labour University.

Centre for Financial Accountability is now on Telegram and WhatsApp. Click here to join our Telegram channel and click here to join our WhatsApp channel and stay tuned to the latest updates and insights on the economy and finance.